Additionally, you can face serious penalties for not possessing commercial car insurance policy. If you are mentioned for not having insurance, you might obtain a fine of over $350, have your car took, and also see a rise in your automobile insurance policy prices. For a repeat infraction, the fine can enhance to $1,800, and also the state may suspend your license for up to 4 years.

Driving a car implies having auto insurance policy, because in California it's a need. The golden state does not play games when it involves driving and also remaining guaranteed. There are lots of car insurance coverage providers using great deals of different choices that fulfill or go beyond the state demands since there are millions of motorists to guarantee.

Typical Cost for Minimum Vehicle Insurance Policy Demands in California, California, like almost all various other states, has actually produced state regulations that mandate car proprietors have to have a certain level of auto insurance policy protection. If you're driving in The golden state, you are lawfully required to have insurance coverage as well as the plan info ought to be in the lorry with you.

Worth, Penguin has the highest possible yearly average of $617 for minimum insurance coverage. Offered that information, it's secure to state auto insurance coverage will certainly set you back around $550 a year or even more if you choose for added coverage.

Typical California Auto Insurance Coverage Costs Past the Minimum, If you stay in The golden state you won't be also surprised to find that the annual expense of automobile insurance coverage is 20% greater on average compared to other states. Yet that's considering all 27 million The golden state vehicle drivers, most of which select to obtain auto insurance protection beyond the minimum needed amounts (vehicle insurance).

The smart Trick of Best Cheap Car Insurance In California 2022 – Forbes Advisor That Nobody is Discussing

55. The Zebra estimates the typical annual premium for California automobile insurance coverage is $1,713 a year. There's a large spread in between the averages completely factor. A whole lot of factors go right into the expense of a vehicle insurance policy premium. Companies are considering your age, marital relationship status, area as well as driving document prior to they offer you a quote.

Generally, where you reside in The golden state can be one of the biggest determining elements for the price of your costs. Some cities will certainly have you paying lower than the national standard, while others will certainly be exorbitantly higher based upon what it resembles driving in the city. In The golden state, it is in fact prohibited for automobile insurance policy providers to think about your credit scores history when establishing your price.

With such a vast amount of choices for automobile insurance provider, it is very important to compare coverage and prices prior to choosing which one you desire to go with (car insurance). Check out this valuable guide on everything you need to recognize concerning car insurance policy in California, including the kinds of price cuts used and the perfect insurance service providers based on your driving type.

If you in fact need to use your auto insurance policy because you are at-fault for an accident then you'll most likely need to pay the insurance deductible (trucks). A deductible is a single, lump-sum that should be paid before the insurance provider will certainly grab the remainder of the tab. Responsibility insurance coverage is all regarding covering the expenditures of others that were associated with the accident.

The car insurance policy deductible is there to aid you manage the expense of a mishap. As opposed to paying the full cost of repairs, for the most part you only need to pay the insurance deductible and the insurance provider handles the remainder. The excellent news is if you are associated with an accident and the at-fault chauffeur is without insurance you might not have to pay the deductible (cheap insurance).

What Does California Car Insurance Minimums And Average Cost - Aaa Mean?

For a couple of bucks extra a month the waiver can help you conserve hundreds or thousands of bucks if someone without insurance hits you because you will not need to pay the deductible. For additional information on the leading insurance coverage service providers in The golden state, take a look at our article comparing insurance coverage suppliers in the Golden State.

* This article was updated on 2/5/21. Krista is a Content Author as well as Editor at Aceable where she has composed numerous online chauffeurs ed & property training courses - low cost auto. She likes utilizing her enthusiasm for composing as well as tracking advertising and marketing patterns to help Aceable's pupils learn needed skills to be successful in their lives and jobs.

Vehicle Insurance Laws and California Teenagers In The Golden State, it is illegal to drive without vehicle insurance coverage. All certified drivers should contend the very least $15,000 of physical injury insurance each, at least $30,000 of physical injury insurance per mishap as well as at least $5,000 of residential property damages insurance. This is called the 15/30/5 guideline.

If a close friend is driving your car and they cause a mishap, you will require to pay your deductible as well as your insurance rates may likely rise. When to Obtain Insurance When it comes to automobile insurance coverage, The golden state teenagers catch a little bit of a break. You'll be covered by your parents' or trainer's insurance coverage while experimenting your authorization, so you won't need insurance coverage of your own till you get your certificate.

Keeping that said, you need to begin analyzing your insurance coverage options when you have your permit to make sure that you'll prepare to go when you get your permit. Choosing a Policy When it comes to choosing a cars and truck insurance alternative that works for you, begin by contacting your moms and dads' insurance representative to locate out exactly how much it would certainly cost to be included in their plan. auto insurance.

Everything about The Best Cheap Car Insurance In California - Business Insider

Many insurers offer multi-car discounts. You can additionally purchase your own plan, yet this can be quite expensive (insured car). Make certain to search for the very best choice.

That means vehicle drivers are monetarily responsible for the results of any type of mishap they cause. There are extremely couple of limitations on the choices of anybody harmed in a mishap, when it comes to going after an insurance case or suit against whoever caused the collision (insure).

You can (and also in some situations ought to) bring more protection to safeguard you in situation a severe collision results in substantial car accident injuries as well as lorry damage. Keep in mind, when policy restrictions are exhausted, you are directly on the financial hook, so higher insurance policy restrictions can aid protect your individual possessions in the event of a serious accident. insurers.

Finally, while California does not call for vehicle drivers to purchase uninsured/underinsured vehicle driver insurance coverage, this type of insurance coverage can offer you with vital economic security if you're in an accident with somebody that has no automobile insurance policy, or whose protection won't pay for your medical costs and also various other losses. Various Other Alternatives for Adhering to The golden state's "Financial Duty" Need While the frustrating majority of cars and truck proprietors in California will buy a cars and truck insurance plan in order to adhere to the state's "financial obligation" regulations, The golden state does allow car proprietors to pick from a couple of other approaches of compliance.

More Info on The Golden State Automobile Insurance Policy For additional information on car insurance coverage in The golden state, straight from the state, see Insurance coverage Requirements for Lorry Enrollment from the California DMV.

California Car Insurance Coverage - Allstate - Truths

Last Verdict California vehicle drivers have lots of alternatives to select from when it comes time to guarantee their automobiles. Throughout the board, Metromile had the ability to use our sample motorists the best prices while additionally giving the benefit of digital tools - prices. There may be a much better choice for you based on your driving history and the type of protection you require.

We discovered that prices differed commonly relying on your driving background as well as the type of coverage you purchase. The average quote we obtained for complete protection was $240 per month, as well as the price for a risky chauffeur was $486 per month on average - cheapest. Just how We Chose the most effective Auto Insurance Policy Carriers in California We picked the very best vehicle insurance policy in California based on detailed research of 22 major insurance providers in the state.

We additionally assessed customer support by interacting with each supplier straight as well as examining third-party data for customer fulfillment (liability). Fees offered are for a solitary grown-up guaranteeing a Honda Accord in Sacramento, The golden state, unless or else kept in mind.

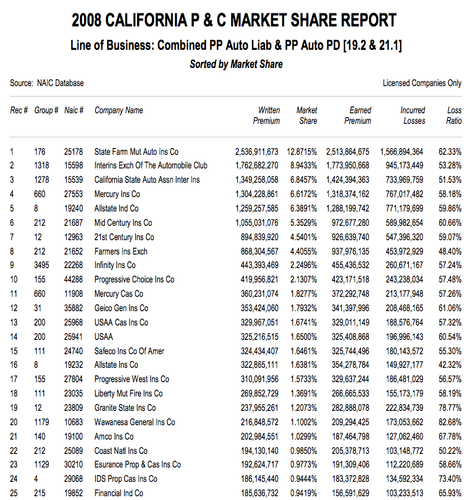

There are almost 40 million people that call The golden state house, making it the most inhabited state in the country. All those automobiles on the roadway develops a special landscape for competition among insurers, as well as locating the best automobile insurance coverage in California is no very easy task. We've put through the information as well as developed a checklist of insurance policy business that are best for the bulk of chauffeurs at different stages in their lives.

As always, the most effective way to locate the ideal automobile insurance for you is to obtain several quotes and contrast terms side by side. The contrast device listed below saves you time by looking for premier insurer in your area (money). Compare Vehicle Insurance Provider in California Esurance has ended up being much extra affordable in pricing its automobile insurance coverage premiums a lot to ensure that it now supplies the least expensive statewide ordinary costs in The golden state.

The Main Principles Of Additional hints How Much Is Car Insurance In California: Average Cost (2022)

Esurance is a subsidiary of Allstate, yet it offers an all-online application procedure that emphasizes rapid authorization. It doesn't have as many insurance coverage options or price cuts as other companies on this listing, but when you're already the lowest-cost provider, those aren't rather as vital. On the cost side, one major advantage it offers is a Switch over & Conserve price cut (car insured).

It's clear Progressive has actually bought modern technology to assist streamline the car insurance policy procedure. suvs. What was once a troublesome as well as dreadful task ends up being a lot easier utilizing Progressive's online devices. As constantly, vehicle drivers should obtain quotes from at the very least 5 various vehicle insurance policy firms before selecting one, but Progressive must be on that list.

The Zebra is an online industry that assists you see the distinctions between vehicle insurance provider. It gives real-time quotes and also has great deals of educational products to assist you much better understand all the terminology and economic language that comes with the car insurance coverage acquiring process. Just how We Selected the Ideal Cars And Truck Insurance Coverage Options in The golden state There are various factors that we took into consideration when score the most effective vehicle insurance coverage companies in California.

Some of the study as well as tools we made use of that assisted develop this listing include: We utilized The golden state data from the Insurance Info Institute to identify which cars and truck insurance business provided the cheapest premiums generally to The golden state vehicle drivers (not simply to excellent motorists or to vehicle drivers with prior events). We incorporated research study from J.D.

The Facts About Best Car Insurance Companies In California - Cars.com Revealed

Auto Insurance VehicleInsurance Coverage which contains an includes just for simply state of California.

If you drive a vehicle in The golden state without insurance policy, the DMV in The golden state states you could: Be mentioned, Have your car penned Final Thoughts Acquiring cars and truck insurance coverage is a monetary decision and also will likely be one of the larger expenditures in your yearly spending plan. Because of that, meticulously take into consideration numerous different quotes from at the very least 5 different cars and truck insurance policy companies in California before determining which one is best for you.

Also, take the time to research any and also all discount rates you could be qualified for. While it may seem like one company provides lower rates than one more, you might also be eligible for certain price cuts not provided by every insurance provider. vehicle. Discover concerning which firms accommodate your particular driving background to ensure that you locate the most effective cars and truck insurer in California for your demands.