Cars and truck insurance plan can consist of various kinds of protection that serve varying objectives, as well as you can choose to be covered by some or every one of them. A few of these coverage choices need deductibles as well as some don't, so it deserves noting what deductibles you'll be called for to pay. State law generally establishes whether an insurance deductible is needed.

This covers you if your automobile rams one more automobile or object as well as you require to spend for fixings. Accident deductibles are typical however differ by insurer. If your vehicle is harmed by an occasion such as fire, a falling item hitting your windscreen or vandalism, you'll submit a detailed protection insurance claim.

If the other vehicle driver in an accident is at mistake yet they aren't guaranteed or don't have enough protection to pay for your building damage, this kind of coverage will concern the rescue. Deductibles are in some cases required for this protection, however not constantly, and needs differ by state. While your cars and truck insurance policy deductible can differ greatly depending on lots of variables, consisting of just how much you intend to pay, cars and truck insurance policy deductibles commonly vary from $100 to $2,500.

When selecting an insurance deductible, you'll require to think about numerous elements, including your budget plan. Invest a long time determining just how much you can pay for to spend for an insurance deductible and also just how much you'll reduce your month-to-month premiums by choosing for a higher one. Ask yourself these questions when selecting an insurance deductible quantity.

insurance affordable cheap car cheap car low cost auto

insurance affordable cheap car cheap car low cost auto

If you obtain in a crash, can you manage the deductible or would you have a hard time to pay it? Taking on a high deductible might not make much sense if it represents a big section of the cars and truck's worth.

Excitement About Should I Raise My Auto Insurance Deductible? - Coverage.com

Note, your vehicle's actual cash value takes into account the price of your vehicle when you acquired it, as well as the age and also condition it remains in at the time of the accident. Just how do I pick a deductible? It is very important to pick an insurance deductible that you fits your economic scenario. insurers.

On the various other hand, if you don't have enough money to cover your deductible in case there's protected damage to your vehicle, you might have trouble getting your auto repaired. To select the right quantity, think of how much you can pay out-of-pocket to have your automobile fixed without experiencing a whole lot of monetary tension in your life. cheaper car insurance.

You have a collision case that creates $6,000 in damage to your automobile, which has a real cash money value of $20,000. 00 insurance deductible.

cheaper cars insurance insure affordable car insurance

cheaper cars insurance insure affordable car insurance

Have concerns concerning your present insurance deductible or adjusting it? Offer us a telephone call at or drop in a Straight Auto Insurance policy location near you (insurance companies).

Let's say you simply entered a wreckage and also your auto requires $4,000 out of commission, yet your insurance will just cover $3,000. If you're puzzled, recognizing your automobile insurance policy deductible could be the answer. In this article, we'll explain what a car insurance coverage deductible actually is, when you need to pay it, and also whether you ought to choose a high or reduced one.

What Is An Auto Insurance Deductible? How Does It Work ... for Beginners

You don't actually pay a deductible to the insurer you pay it to the fixing store when they fix your auto. Depending on your state, you could have an insurance deductible for various other types of coverage, too. Allow's say you submit a claim that causes a $2,000 expense. If you have a $500 deductible, you must pay that quantity before the insurance policy business pays the continuing to be $1,500.

Your car insurance policy deductible does not work like your health and wellness insurance policy deductible. With wellness insurance, you have a deductible that gets reset every year.

When the brand-new year rolls around, it all begin again. With vehicle insurance, you pay your insurance deductible every single time you file an insurance claim. Let's claim you got right into a mishap and submitted a crash case. On your way to the service center, a fanatic hail storm adds more damages to your vehicle - affordable auto insurance.

There is no limit to how numerous times you pay your insurance deductible in a year. Exactly How Do Automobile Insurance Policy Deductibles Work?

If you live in a location with frequent negative climate, you may want to select a reduced detailed deductible to restrict what you pay out of pocket. At the exact same time, you can maintain your collision insurance deductible greater to stabilize out your auto insurance coverage premium.

The Basic Principles Of Automobile Insurance - Official Website

Because case, your automobile insurance coverage premium would set you back more to counter the $0 auto insurance policy deductible. When Do You Pay An Auto Insurance Policy Deductible? Right here are the main circumstances in which you would certainly be accountable for paying an insurance deductible: If you cause an automobile crash and also your automobile needs repair services, you'll pay your deductible on your accident protection. risks.

car insurance insurers car low cost auto

car insurance insurers car low cost auto

How To Select A Car Insurance Deductible Since you understand what an automobile insurance coverage deductible is, it is essential to choose the right deductible for your circumstance. You need to choose a high auto insurance coverage deductible if you wish to reduce your monthly costs as well as if you have the ability to pay it.

If you don't have any kind of cost savings, it's not a smart concept to have a high insurance deductible. You could be the most effective motorist in the world, yet you Look at this website still share the roadway with negative motorists and also without insurance drivers. According to the Insurance Policy Info Institute, concerning 6 percent of motorists who had crash protection submitted an insurance claim in 2018.

You can constantly choose a lower deductible while you save up an emergency situation fund and after that elevate the deductible in the future. You must choose a low auto insurance coverage deductible if you do not have the capacity to pay a high one, or if you desire to protect your out-of-pocket prices. A low insurance deductible could be an excellent suggestion if you stay in an overloaded area where you have a higher opportunity of experiencing a crash.

Some programs will reset your deductible to the full amount after you make a case, and also others will reset it to a smaller sized quantity. Lastly, these programs aren't free. They can cost around $20 or even more annually. After five years, you would have paid an added $100 or even more to your insurer.

The Best Strategy To Use For Compulsory & Voluntary Deductibles In Car Insurance

What Occurs If You Can Not Pay Your Deductible? When paying out an insurance claim, your insurance provider will certainly usually write you a look for the amount it's accountable for covering. If you are not able to pay the remainder of your prices for the insurance deductible, you may have some choices. Below are some steps you can take if you can not afford to pay your insurance deductible: Maybe rewarding to speak to your auto mechanic concerning repayment alternatives after a mishap. auto.

vans auto insurance cheap accident

vans auto insurance cheap accident

Understanding when to readjust your deductible and also when to look around for a brand-new vehicle insurance coverage business with economical prices is the safest way to prevent high costs in the future (perks). Our Suggestions For Car Insurance Searching for automobile insurance doesn't have to be difficult. Simply make certain to get quotes from numerous service providers, so you can contrast rates.

If you've currently experienced a claim, you have actually likely learned exactly how your insurance deductible jobs very first hand. For those who haven't, it can create complication around simply what a deductible is and that spends for it. cheap. What a deductible is A deductible is the quantity of money you (the named insured on the policy) pays out of pocket for the cost of problems prior to the insurer pays.

Your insurer will certainly pay the remaining equilibrium of $500 to the garage. SCENARIO 2: In this circumstance, expect you suffer a protected loss with overall damage to your protected car totaling $500. Considering that you have actually selected a $500 deductible, you will certainly be accountable for the costs. You should not commonly expect to obtain any type of payment from your insurance firm in this scenario.

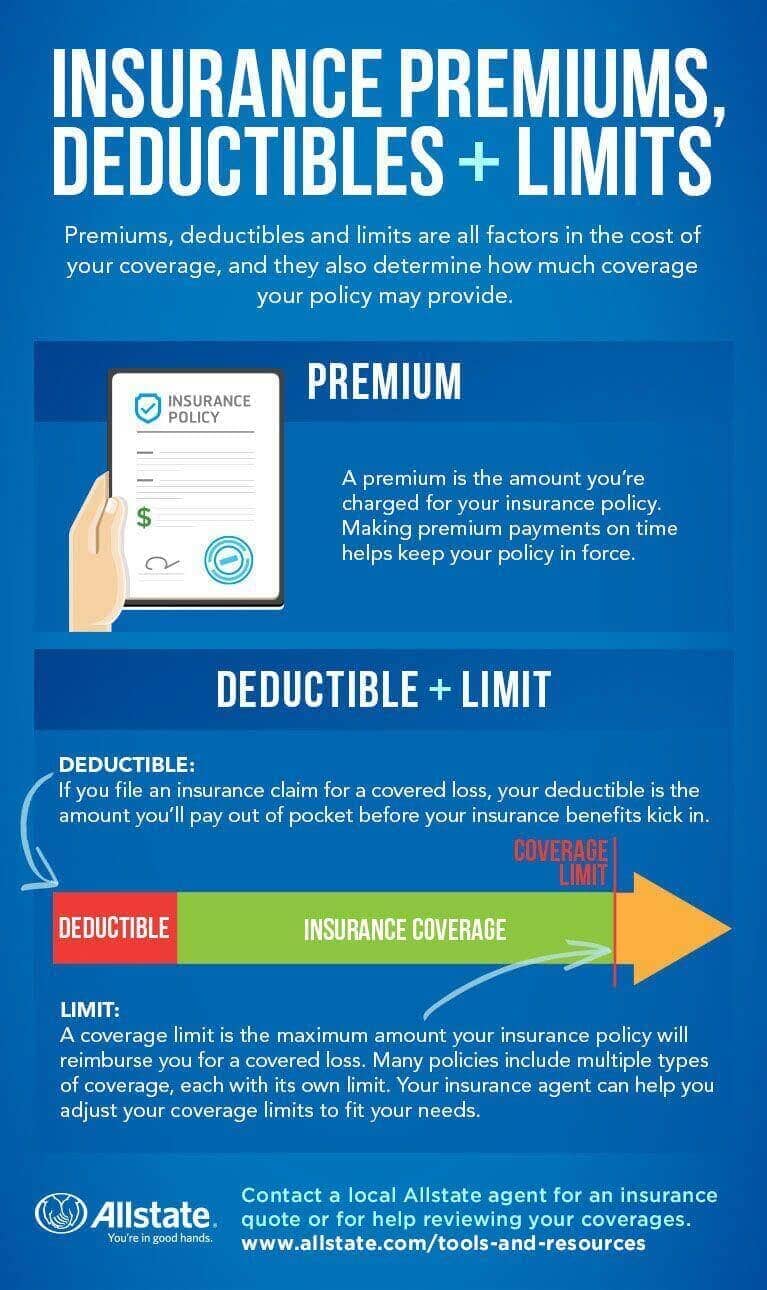

It's not component of the costs. When you pay your insurance premium, you aren't contributing to a cost savings account versus future losses. While the quantity of your deductible can increase or reduce your costs, deductible as well as premium are two different things. It's not something that the insurance coverage firm pays. The named guaranteed on the policy is accountable for paying the insurance deductible quantity.

Getting My Is High-deductible Car Insurance The Right Choice For You ... To Work

This means that also if somebody else was driving your car as well as entered a mishap, your insurance company would take care of the case and also you would certainly be accountable for your policy deductible. It's not the exact same as a medical insurance deductible. insurance. Deductibles for medical insurance plans normally cover a whole one year, meaning you would only compensate for your deductible (i.

Nevertheless, a car insurance deductible uses "per incident." This suggests you are liable for your full insurance deductible amount each time you suffer a covered loss. As with all points insurance policy, it's finest to discuss deductibles and just how they use in your scenario with a neighborhood independent insurance policy agent. Your regional independent representative has the understanding and also experience to respond to regularly asked questions concerning deductibles and compute price savings for you depending upon the deducible quantity you pick.

When it involves cars and truck insurance policy, an insurance deductible is the amount you 'd have to pay of pocket after a protected loss prior to your insurance protection starts. Cars and truck insurance coverage deductibles function differently than clinical insurance deductibles with automobile insurance, not all kinds of coverage need an insurance deductible. Obligation insurance policy doesn't require an insurance deductible, however thorough as well as crash protection usually do.

When you're including that coverage to your vehicle insurance coverage, you'll normally have the chance to decide where you wish to establish the deductible. vehicle. Normally, the higher you set your insurance deductible, the lower your regular monthly insurance coverage premiums will certainly be however you don't intend to establish it so high that you would not have the ability to really pay that quantity if required.

What does an automobile insurance deductible mean? A insurance deductible is the quantity of money you have to pay out of pocket before your car insurance coverage will cover the remainder - perks. As an example, if you backed your car into a telephone post, your accident insurance would spend for the expense of the damages.

No Deductible Car Insurance, Explained - Getjerry.com Fundamentals Explained

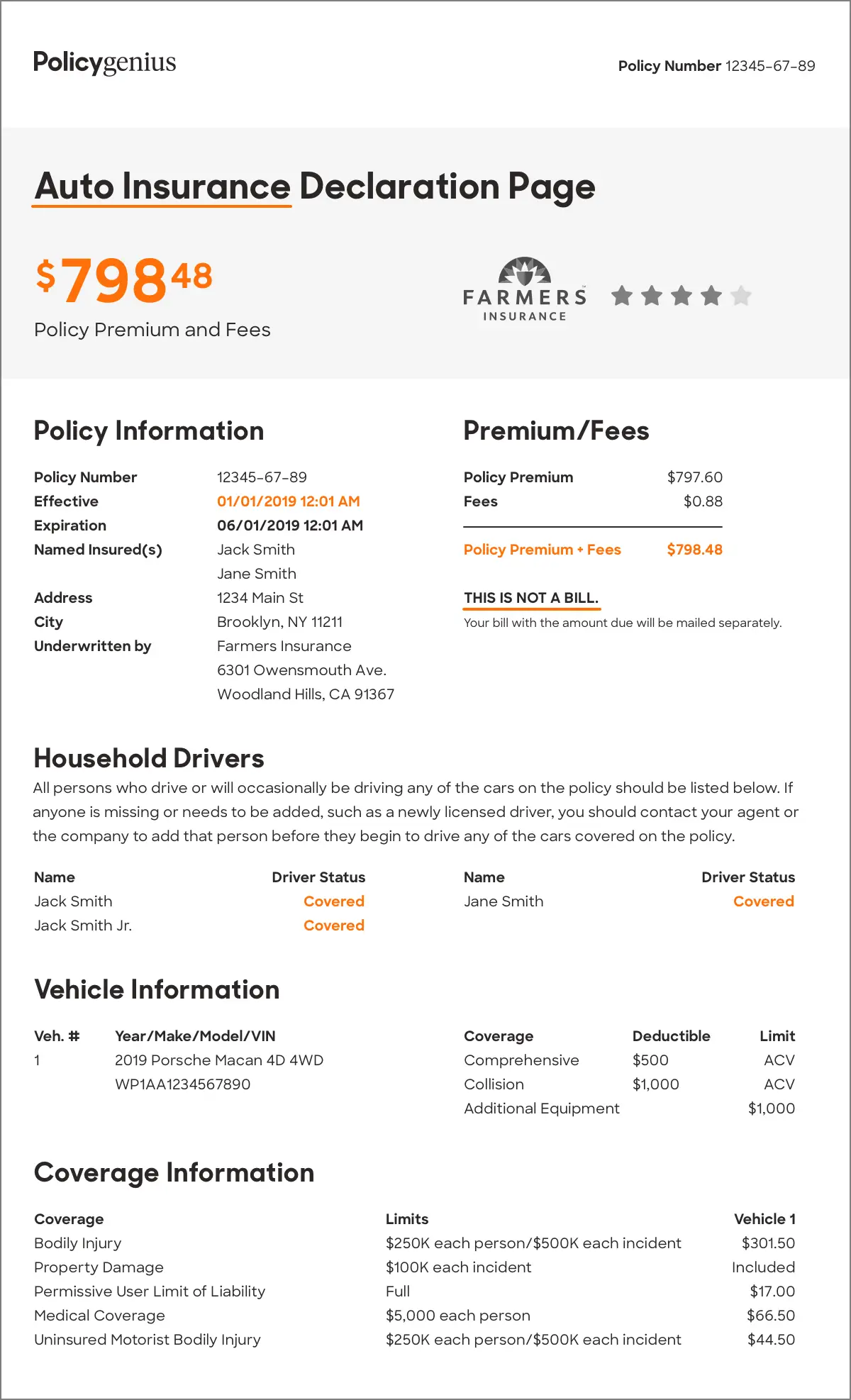

If the overall price of repair work comes to $1800, your insurance coverage will only pay for $1300 (vehicle insurance). You can find your insurance deductible amounts is listed on your declarations page. Having to pay an insurance deductible methods you can do a kind of cost-benefit evaluation prior to you make an insurance claim with your insurer.

What kind of protection calls for a deductible?, which covers the expenses if you damage someone's residential property or harm somebody with your auto, never ever calls for an insurance deductible., and where you set your insurance deductible will certainly have an affect on your month-to-month insurance coverage premium.